The short answer is “yes”, you have 1 month grace.

The ÖAMTC website has basically all the information you need about how to go about it.

A quick summary:

If your main residence is in Austria (and if you are on this site, it probably is), that is, you are not here on holiday or a business trip, you have one month from the date of the vehicle’s first entry into Austria to import and register the vehicle. Short trips abroad will not reset the clock. After that first month you must either import it or remove it from the country. This applies to any vehicle with foreign plates – even ones from another EU country. The authorities will assume (legally) that you car is here permanently, and the onus is on you to prove that it has been here less than a month.

To import your car you are required to register your car, pay a one-off fuel consumption tax called NoVANormverbrauchsabgabe The Normverbrauchsabgabe (NoVA) is a one-off fuel consumption tax to be paid at your local tax office when importing a car previously on foreign number plates. (NormverbrauchsabgabeNormverbrauchsabgabe The Normverbrauchsabgabe (NoVA) is a one-off fuel consumption tax to be paid at your local tax office when importing a car previously on foreign number plates.) at your local tax office and exchange your UK number plates for Austrian plates at your nearest vehicle registration office (Kfz-Zulassungsstelle). You are required to have valid motoring insurance in order to be able to exchange your number plates.

Potential consequences

- A “VerwaltungsstrafeVerwaltungsstrafe A Verwaltungsstrafe is a fine issued by an administrative authority rather than a court in relation of (minor) breaches of legal provisions. Examples of offences include fail to register an imported vehicle within the required timeframe, failure to have the necessary residence documents etc.” (administrative fine) for not importing in time.

- Your UK insurance coverage may be invalid, and you could be liable for a huge amount if you have an accident.

- Fines and court process due to tax evasion (road tax, NoVA and VAT)

Legal basis (in German):

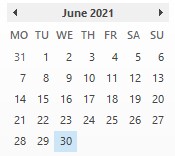

| Holders of British driving licences as at the end of the transition periodTransition Period The transition period (also referred to as the implementation period) is the period following the UK's departure from the European Union (on 31.01.2020) until the end of 2020. An option to extend this period has not been taken up by the UK government. (31.12.2020) had until 30 June 2021 to exchange their British driving licence for an Austrian one, if resident in Austria. Continuing to drive on a British licence under this circumstance is illegal and incurs heavy fines and may render insurance ineffective. |